Second Quarter Highlights:

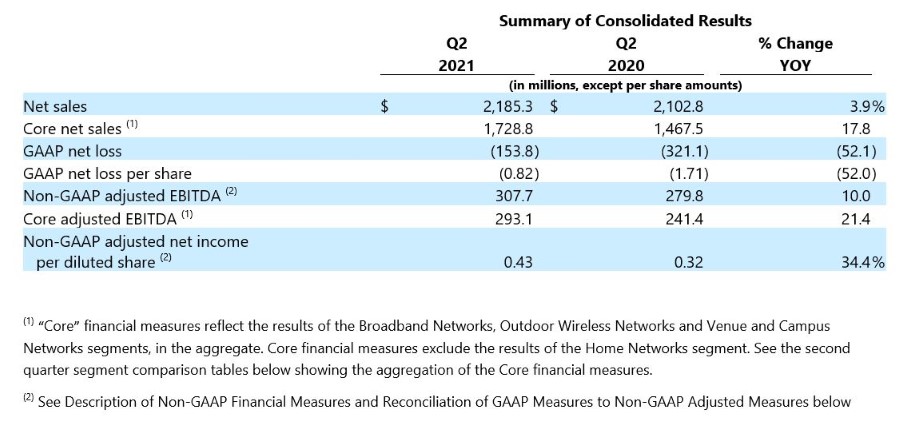

- Net sales of $2.185 billion

- Core net sales of $1.729 billion*

- GAAP net loss of $(153.8) million

- Non-GAAP adjusted EBITDA of $307.7 million

- Core adjusted EBITDA of $293.1 million*

-

Cash flow generated by operations of $191.6 million and non-GAAP adjusted free cash flow of $197.8 million

-

References to certain supplementary “Core” financial measures reflect the results of the Broadband Networks, Outdoor Wireless Networks and Venue and Campus Networks segments, in the aggregate. Core financial measures exclude the results and performance of the Home Networks segment. See the second quarter segment comparison tables below showing the aggregation of the Core financial measures.

** HICKORY, NC— CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader in network connectivity solutions, today reported results for the quarter ended June 30, 2021.

“Our second quarter results demonstrate strong execution and some early quick wins with our CommScope NEXT initiative offsetting a portion of our inflationary impacts with a longer term focus on optimizing our portfolio and delivering strong revenue growth,” said Chuck Treadway, president and chief executive officer. “Despite ongoing global supply chain challenges, our team remained focused and continued to deliver for our customers. We remain encouraged by opportunities to capitalize on industry tailwinds such as the demand for 5G, the recent launch of HELIAX® SkyBlox™ to meet the demand for network upgrades and the help we provide operators to put reliable mobile networks in place.”

Treadway continued, “Looking ahead, while we expect these challenges to continue, with our strong demand environment and ability to adapt, we remain confident in our ability to build on our track record of value creation and to successfully execute our CommScope NEXT strategy. All of our dedicated employees work every day to deliver innovative solutions for network convergence for our customers and position CommScope for the next level of growth and profitability.”

Alex Pease, executive vice president and chief financial officer, said, “While we are pleased with our second quarter performance and strong demand outlook, we will need to work hard in the back half of this year to stabilize the challenges within our global supply chains. CommScope continues to position itself to reinvest in our core strategic markets and technologies, capitalizing on growth opportunities in our Broadband, Outdoor Wireless and Venue and Campus segments. As we move into the second half of the year, growth, cost control and portfolio optimization will continue to be our priorities.”

Second Quarter Results and Comparison

In early April 2021, CommScope announced its plan to spin-off the Home Networks business. Also in the second quarter of 2021, management shifted certain product lines from the Company’s Broadband segment to its Home segment to better align with how the business is being managed in light of the planned spin-off of the Home Networks business. All prior period amounts have been recast to reflect these operating segment changes.

In this comparison discussion, reference is made to certain supplementary “Core” financial measures, which reflect the results of the Broadband Networks, Outdoor Wireless Networks and Venue and Campus Networks segments, in the aggregate. Core financial measures exclude the results of the Home Networks segment. These metrics represent the business segments as reported by CommScope. However, the ultimate definition of the Home Networks business that CommScope expects to spin-off may vary, and future results may differ materially.

Reconciliations of the reported GAAP results to non-GAAP adjusted results can be found at https://ir.commscope.com/.

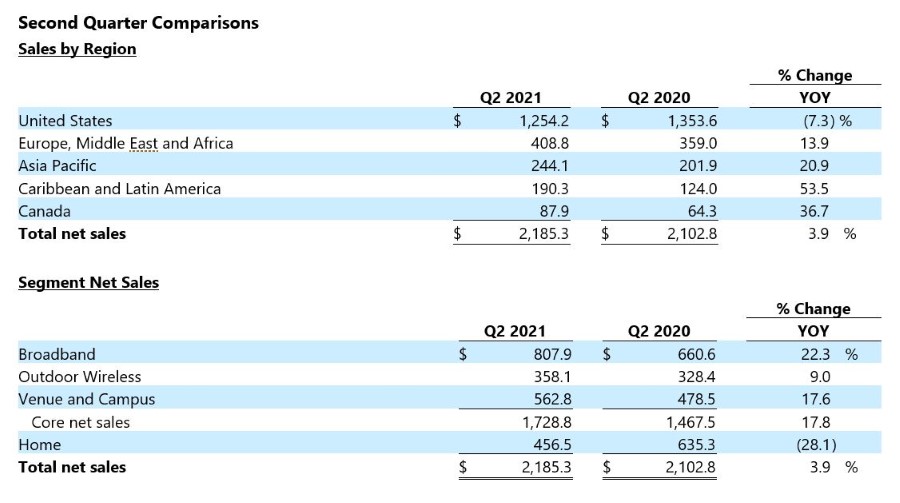

Net sales in the second quarter of 2021 increased 3.9% year over year to $2.19 billion. Core net sales increased 17.8% year over year primarily due to higher net sales in the Broadband Networks and Venue and Campus Networks segments.

Net loss of $(153.8) million, or $(0.82) per share, in the second quarter of 2021, decreased 52.1% compared to the prior year period's net loss of $(321.1) million, or $(1.71) per share. Non-GAAP adjusted net income for the second quarter of 2021 was $105.7 million, or $0.43 per share, versus $76.9 million, or $0.32 per share, in the second quarter of 2020.

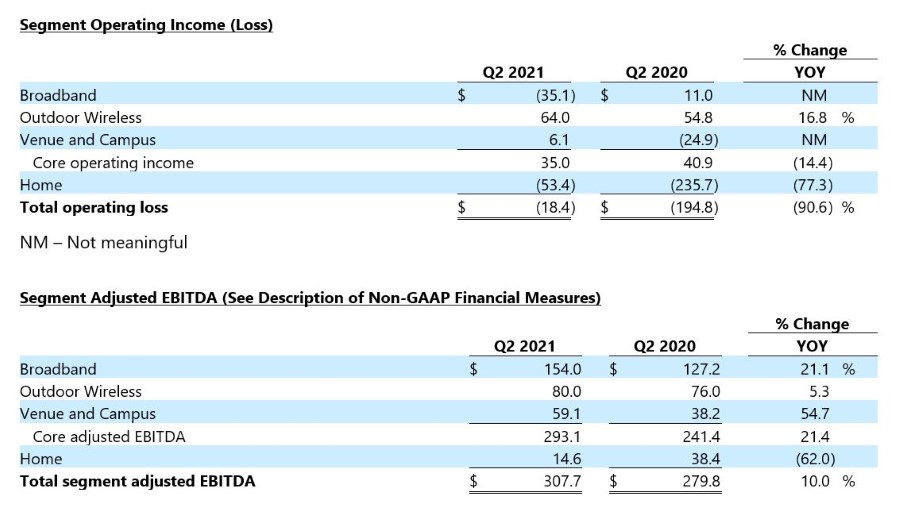

Non-GAAP adjusted EBITDA increased 10.0% to $307.7 million in the second quarter of 2021 compared to the same period last year. Non-GAAP adjusted EBITDA improved to 14.1% of net sales in the second quarter of 2021 compared to 13.3% of net sales in the same prior year period. Core segment adjusted EBITDA increased 21.4% in the second quarter of 2021 and improved to 17.0% of net sales compared to 16.4% of net sales in the prior year period. The negative impact of COVID-19 on our financial performance has eased during the first half of 2021, with network strain driving increased demand for our Broadband segment products in particular. The recovery in demand has also had unfavorable business impacts, including commodity inflation (primarily copper and resins), logistics cost increases and certain component part shortages. All of the Company’s segments experienced supply shortages and extended lead times for certain materials that negatively affected our ability to meet customer demand for our products. We expect certain of these unfavorable impacts to continue into 2022.

- Net sales of $807.9 million, increased 22.3% from prior year driven by growth in both Network Cable & Connectivity and Access Technologies.

- Net sales of $358.1 million, increased 9.0% from prior year driven by growth in both Macro Tower Solutions and Metro Cell Solutions.

- Net sales of $562.8 million, increased 17.6% from prior year primarily driven by growth in Indoor Copper Enterprise, RUCKUS Networks and Indoor Fiber Enterprise, offset by declines in DAS and Small Cell.

- Net sales of $456.5 million, decreased 28.1% from prior year driven by declines in Home Media Solutions and Broadband Connectivity Devices.

Cash Flow and Balance Sheet

- GAAP cash flow from operations was $191.6 million.

- Non-GAAP adjusted free cash flow was $197.8 million after adjusting operating cash flow for $33.8 million of additions to property, plant and equipment, $24.8 million of cash paid for restructuring costs and $15.2 million of cash paid for transaction, transformation and integration costs.

- Ended the quarter with $446.2 million in cash and cash equivalents.

- As of June 30, 2021, the Company had no outstanding borrowings under its asset-based revolving credit facility and had availability of $729.7 million, after giving effect to borrowing base limitations and outstanding letters of credit. The Company ended the quarter with total liquidity of approximately $1.18 billion.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.