First Quarter Highlights

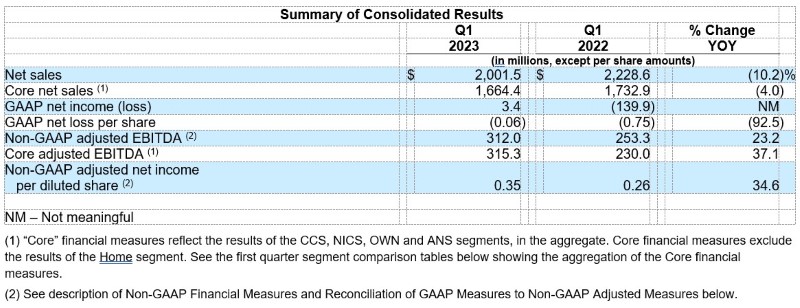

- Net sales of $2.002 billion

- Core net sales of $1.664 billion*

- GAAP net loss attributable to common stockholders of $11.7 million

- Non-GAAP adjusted EBITDA of $312.0 million

- Core adjusted EBITDA of $315.3 million*

-

Cash flow used in operations of $(46.1) million and non-GAAP adjusted free cash flow of $(39.7) million

-

References to certain supplementary “Core” financial measures reflect the results of the Connectivity and Cable Solutions (CCS), Networking, Intelligent Cellular and Security Solutions (NICS), Outdoor Wireless Networks (OWN) and Access Network Solutions segments (ANS), in the aggregate. Core financial measures exclude the results and performance of the Home Networks (Home) segment. See the first quarter segment comparison tables below showing the aggregation of the Core financial measures.

HICKORY, NC, May 4, 2023 — CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader in network connectivity solutions, today reported results for the quarter ended March 31, 2023.

“CommScope delivered Core net sales of $1.66 billion and Core adjusted EBITDA of $315 million for the first quarter of 2023. This represents a 37% improvement in Core adjusted EBITDA over the first quarter of 2022 as our CommScope NEXT initiative continues to support improving EBITDA margins. I’m pleased with our team’s performance as we continue to aggressively manage the components of our business that we control. CommScope NEXT is paying dividends with strong focus on the most important initiatives. A great example of this progress is in our NICS segment where the team delivered $58 million of EBITDA in Q1, a $72 million improvement year-over-year. Current order input remains low as customers deal with high inventory levels and project delays as they manage through the uncertain economic environment. However, market feedback indicates a strong recovery in the second half as fiber deployment, infrastructure upgrades and continued need for more bandwidth drive strong market fundamentals. We are well positioned to take advantage of the growing market, as we announced more capacity additions in our fiber business during the first quarter. Based on current demand visibility driven by customer signaling a strong second half order rate, we maintain our expectation that we will deliver Core adjusted EBITDA in the $1.35 to $1.5 billion range,” said Chuck Treadway, President and Chief Executive Officer.

“We are pleased with our first quarter results as evident by the 37% Core adjusted EBITDA growth year-over year. The improved EBITDA performance allowed us to generate cash that we used to deleverage as we retired $57 million of debt in the first quarter. With our LTM Core adjusted EBITDA of $1,337 million, a 7% improvement over prior quarter, and our debt reduction, we finished the quarter at adjusted leverage ratio of 6.6x. We will continue to focus on deleveraging as we move through 2023,” said Kyle Lorentzen, Chief Financial Officer.

CommScope NEXT

Since 2021, the Company has been engaged in a transformation initiative referred to as CommScope NEXT, which is designed to drive shareholder value through three pillars: profitable growth, operational efficiency and portfolio optimization. CommScope believes these efforts are critical to making the Company more competitive and allowing it to invest in growth, de-lever and maximize stockholder and other stakeholder value in the future.

As a step in the CommScope NEXT transformation plan, in 2021, the Company announced a plan to separate the Home Networks (Home) segment. Due to the impact of the uncertain supply chain environment, capital spending pattern of customers and other macroeconomic factors related to the Home segment, the Company has delayed the separation plan but continues to analyze the financial results of its "Core" business separately from Home. As such, in this comparison discussion, reference is made to certain supplementary Core financial measures, which reflect the results of the Connectivity and Cable Solutions (CCS), Outdoor Wireless Networks (OWN), Networking, Intelligent Cellular and Security Solutions (NICS) and Access Network Solutions (ANS) segments, in the aggregate.

Impacts of Current Economic Conditions

Macroeconomic factors such as higher interest rates, inflation and concerns about a global economic slow-down have softened demand for CommScope's products, with certain customers reducing purchases as they right-size their inventories and others pausing capital spending. This has negatively impacted the Company's net sales for the first quarter of 2023 and may continue to negatively impact net sales further into 2023. While supply chain constraints are loosening in some segments, CommScope continues to experience shortages of memory devices, capacitors and silicon chips, which has decreased net sales and increased costs and inventory balances for certain of its segments. These shortages could continue throughout 2023. Conversely, the Company has seen favorable pricing impacts and declining freight costs that have offset the impact of lower demand and supply chain constraints. CommScope also proactively implemented cost savings initiatives that have favorably impacted its profitability in the first quarter of 2023.

First Quarter Results and Comparisons

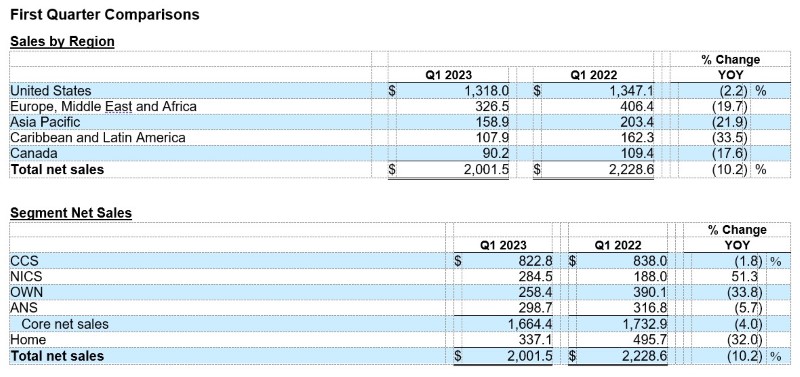

Net sales in the first quarter of 2023 decreased 10.2% year-over-year to $2.00 billion. Core net sales decreased 4.0% year-over-year due to lower net sales in the OWN, ANS and CCS segments, partially offset by stronger sales in the NICS segment. Net sales decreased across all regions in the first quarter of 2023.

Net loss attributable to common stockholders of $11.7 million, or $(0.06) per share, in the first quarter of 2023, improved compared to the prior year period's net loss attributable to common stockholders of $154.4 million, or $(0.75) per share. Non-GAAP adjusted net income for the first quarter of 2023 was $89.4 million, or $0.35 per share, versus $64.4 million, or $0.26 per share, in the first quarter of 2022.

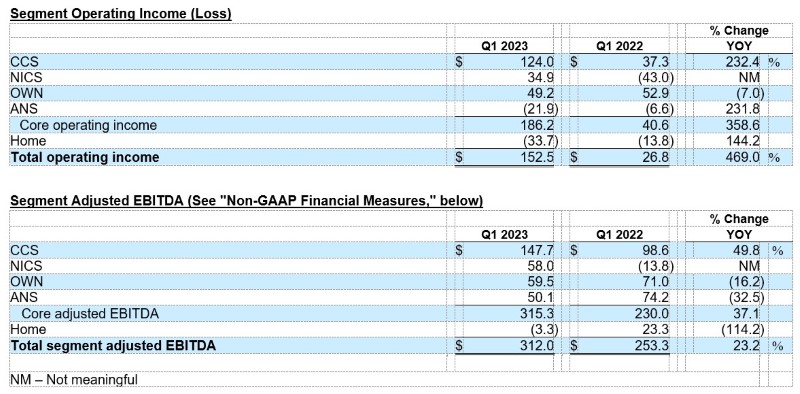

Non-GAAP adjusted EBITDA increased 23.2% to $312.0 million in the first quarter of 2023 compared to the same period last year. Non-GAAP adjusted EBITDA as a percentage of net sales increased to 15.6% in the first quarter of 2023 compared to 11.4% in the same prior year period. Core segment adjusted EBITDA increased 37.1% to $315.3 million in the first quarter of 2023 compared to the same prior year period. Core segment adjusted EBITDA as a percentage of net sales increased to 18.9% in the first quarter of 2023 compared to 13.3% in the same prior year period.

Reconciliations of the reported GAAP results to non-GAAP adjusted results can be found at https://ir.commscope.com/.

-

CCS - Net sales of $822.8 million decreased 1.8% from the prior year period driven by declines in Building and Data Center Connectivity products, partially offset by higher Network Cable and Connectivity product net sales.

-

NICS - Net sales of $284.5 million increased 51.3% from the prior year period driven by growth in Ruckus Networks.

-

OWN - Net sales of $258.4 million decreased 8% from the prior year period driven by declines in Base Station Antennas and HELIAX products.

-

ANS - Net sales of $298.7 million decreased 5.7% from the prior year period driven by a decline in Access Technologies.

-

Home - Net sales of $337.1 million decreased 32.0% from the prior year period driven by a decline in Broadband Home Solutions.

Cash Flow and Balance Sheet

-

GAAP cash flow used in operations was $(46.1) million.

-

Non-GAAP adjusted free cash flow was $(39.7) million after adjusting operating cash flow for $14.4 million of additions to property, plant and equipment, $19.6 million of cash paid for restructuring costs and $1.2 million of cash paid for transaction, transformation and integration costs.

-

Ended the quarter with $327.3 million in cash and cash equivalents.

-

As of March 31, 2023, the Company had no outstanding borrowings under its asset-based revolving credit facility and had availability of $907.3 million, after giving effect to borrowing base limitations and outstanding letters of credit. The Company ended the quarter with total liquidity of approximately $1,234.6 million.