HICKORY, NC — CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader in network connectivity solutions, today reported results for the quarter ended March 31, 2021.

(1) “Core” financial measures reflect the results of the Broadband Networks, Outdoor Wireless Networks and Venue and Campus Networks segments, in the aggregate. Core financial measures exclude the results of the Home Networks segment. See the first quarter segment comparison tables below showing the aggregation of the Core financial measures.

(2) See Description of Non-GAAP Financial Measures and Reconciliation of GAAP Measures to Non-GAAP Adjusted Measures below

“With strong execution and demand across our portfolio, we are pleased to report solid first quarter financial results,” said Chuck Treadway, president and chief executive officer. “These results are a testament to our team’s dedication to serving our customers and enhancing our core businesses. We are also encouraged by strengthening market conditions and the opportunities we see to capitalize on industry tailwinds ahead such as 5G and mobile network densification, indoor coverage and private networks, distributed access architectures and fiber-rich optical networks, as the economy and our industry continue to recover from the COVID-19 pandemic.”

Treadway continued, “Looking ahead, we are committed to refocusing our commercial and technology footprint around a more tightly integrated portfolio following our recent announcement to spin off our Home Networks business. We continue to take action to position CommScope for success as we execute on our CommScope NEXT strategy to optimize the business portfolio, drive above-market growth, and control costs.”

Alex Pease, executive vice president and chief financial officer, said, “During the first quarter we adapted to changing market conditions and delivered solid increases in revenue and profitability. Following the planned spin-off of our Home Networks business, we will be better able to reinvest in our core strategic markets and technologies to capitalize on the growth opportunities in our Broadband, Outdoor Wireless and Venue and Campus segments. With our optimized business portfolio, we expect to continue to build on the momentum we have seen so far this year.”

First Quarter Results and Comparison

In early April 2021, CommScope announced its plan to spin-off the Home Networks business. In this comparison discussion, reference is made to certain supplementary “Core” financial measures, which reflect the results of the Broadband Networks, Outdoor Wireless Networks and Venue and Campus Networks segments, in the aggregate. Core financial measures exclude the results of the Home Networks segment. These metrics represent the business segments as historically reported by CommScope. However, the ultimate definition of the Home Networks business that CommScope expects to spin-off may vary, and future results may differ materially.

Reconciliations of the reported GAAP results to non-GAAP adjusted results can be found at https://ir.commscope.com/.

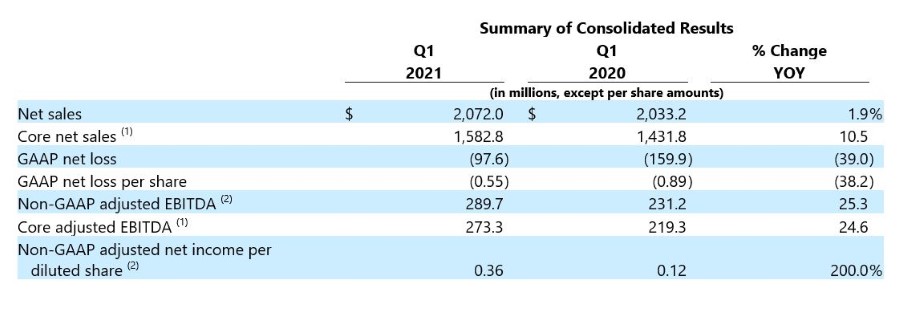

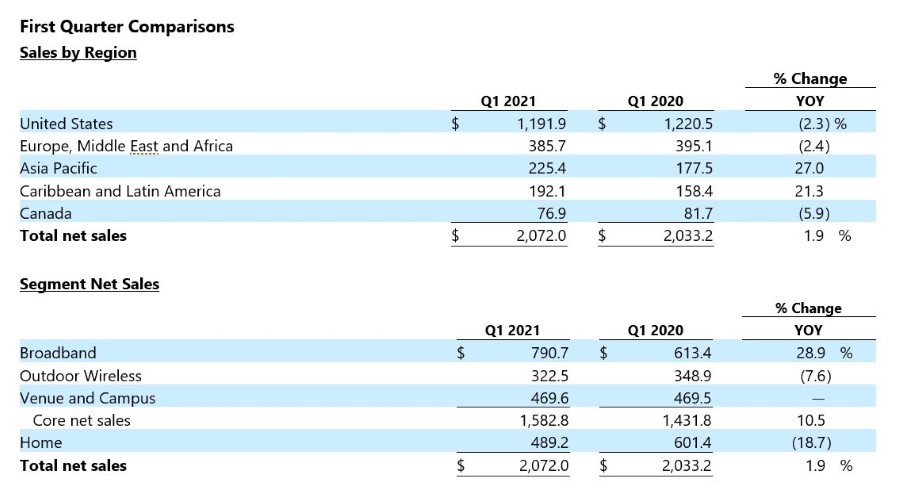

Net sales in the first quarter of 2021 increased 1.9% year over year to $2.07 billion. Core net sales increased 10.5% year over year primarily due to higher net sales in the Broadband Networks segment.

Net loss of $(97.6) million, or $(0.55) per share, in the first quarter of 2021, decreased 39.0% compared to the prior year period's net loss of $(159.9) million, or $(0.89) per share. Non-GAAP adjusted net income for the first quarter of 2021 was $88.3 million, or $0.36 per share, versus $27.2 million, or $0.12 per share, in the first quarter of 2020.

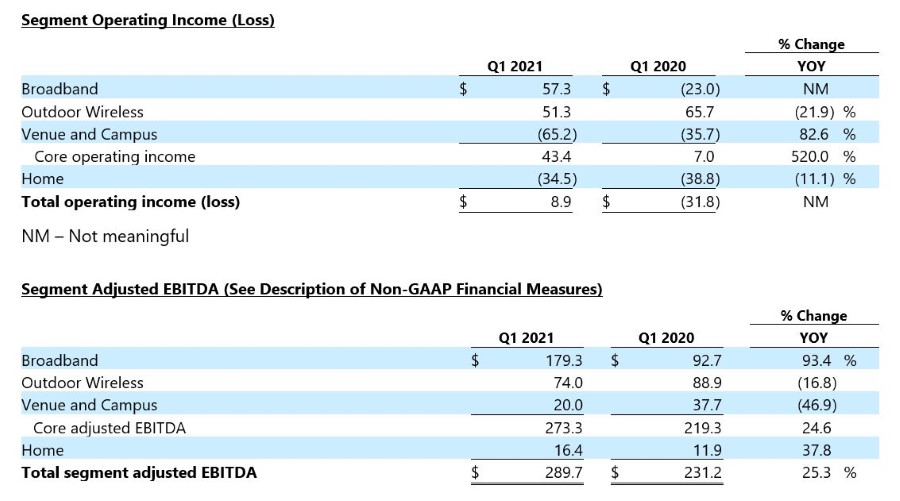

Non-GAAP adjusted EBITDA increased 25.3% to $289.7 million in the first quarter of 2021 compared to the same period last year. Non-GAAP adjusted EBITDA improved to 14.0% of net sales in the first quarter of 2021 compared to 11.4% of net sales in the same prior year period. Core segment adjusted EBITDA increased 24.6% in the first quarter of 2021 and improved to 17.3% of net sales compared to 15.3% of net sales in the prior year period. The Company is facing supply shortages and delays that negatively affected adjusted EBITDA in the three months ended March 31, 2021, and those constraints are expected to persist at least into the second half of 2021. The COVID-19 outbreak also continued to have a mixed impact on the Company’s financial performance during the first quarter of 2021, with network strain driving increased demand for the Broadband Networks segment products, while the other segments have been negatively impacted due to the general economic slowdown.

- Net sales of $790.7 million, increased 28.9% from prior year driven by growth in both Network Cable & Connectivity and Network & Cloud.

- Net sales of $322.5 million, decreased 7.6% from prior year driven by declines in Metro Cell Solutions and Macro Tower Solutions.

- Net sales of $469.6 million remained relatively flat from prior year primarily driven by growth in RUCKUS Networks offset by moderate declines in Indoor Copper Enterprise, Indoor Fiber Enterprise and DAS and Small Cell.

- Net sales of $489.2 million, decreased 18.7% from prior year driven by declines in Home Media Solutions and Broadband Connectivity Devices.

Cash Flow and Balance Sheet

- GAAP cash flow from operations of $(124.0) million.

- Non-GAAP adjusted free cash flow was $(135.0) million after adjusting operating cash flow for $26.4 million of additions to property, plant and equipment, $7.2 million of cash paid for restructuring costs and $8.2 million of cash paid for transaction, transformation and integration costs.

- Ended the quarter with $325.9 million in cash and cash equivalents.

- As of March 31, 2021, the Company had no outstanding borrowings under its asset-based revolving credit facility and had availability of $686.9 million, after giving effect to borrowing base limitations and outstanding letters of credit. The Company ended the quarter with total liquidity of approximately $1.01 billion.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.