Source: Vodafone Group

- At long last, details of the Vodafone UK and Three merger have been agreed and shared

- If the merger is approved, it will be the UK’s largest mobile operator by subscriber numbers, with annual revenues of more than £8.4bn

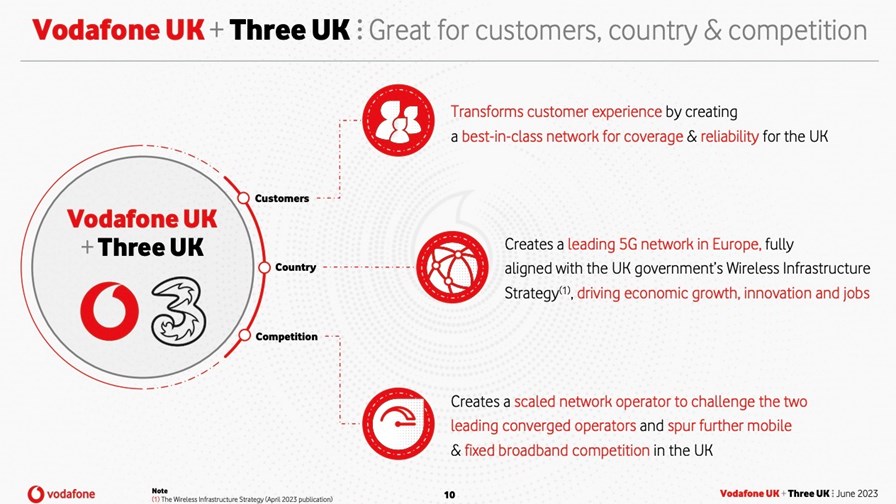

- Parent groups argue the move will be good for the UK market and customers

- But there are major regulatory hurdles to overcome

After years of talks and months of heightened expectation, details of the planned merger between mobile operators Vodafone UK and Three have finally been revealed, and as expected there are major doubts as to whether the planned merger will get all the regulatory approval it needs.

The parent companies of the two UK operators, Vodafone Group and CK Hutchison Group Telecom Holdings Limited (CKHGT), announced their intention to merge their respective UK operations in October last year following years of stop-start talks – see Vodafone and Three UK go public about their marriage plans.

Now they have revealed the nitty gritty details. As expected, the merger would not involve any payment between the parties – the businesses would be combined, with Vodafone Group holding a 51% stake and CKHGT a 49% stake in an operator that is valued by the prospective owners at £16.5bn.

Based on current statistics and financial reports, the merged entity would become the UK’s biggest mobile operator measured by customer numbers, with almost 28 million customers (17.9 million from Vodafone UK and just over 10 million from Three). Its annual revenues would be more than £8.4bn (£5.9bn from Vodafone and £2.5bn from Three).

That would put it ahead of Virgin Media O2, which has more than 24 million mobile customers, and BT Group’s mobile division, EE, which is estimated to have just over 20 million mobile users.

The companies are keen for the merger to be seen as positive for the UK, so that regulators will approve the deal. They say the merged entity would invest more than £11bn in the decade following a completed merger deal to build out a 5G network that would reach more than 99% of the UK population with “one of Europe’s most advanced standalone 5G networks.”

The resulting operator, currently referred to as MergeCo, would have Vodafone UK’s current chief, Ahmed Essam, as its CEO, while Three’s CFO Darren Purkis would be MergeCo’s chief bean-counter. There are many more details associated with the planned merger, and you can read them in this press release.

But as has long been recognised, the merger would reduce the number of independent, infrastructure-based mobile network operators in the UK from four to three, and that concerns competition advocates.

Vodafone and Three, of course, argue that the merger would be “great for competition”. How so? “The merger will create a third operator with scale, levelling the competitive playing field, increasing competition to the UK’s two leading converged operators and will also provide more choice in wholesale partners for the UK’s already competitive MVNOs [mobile virtual network operators]. The combined business will offer fixed wireless access (mobile home broadband) to 82% of households by 2030, complementing MergeCo's access to the UK's biggest full fibre footprint,” they noted.

Vodafone Group CEO Margherita Della Valle (who would be even more well regarded if she can get this deal over the line), claimed: “The merger is great for customers, great for the country and great for competition. It’s transformative as it will create a best-in-class – indeed best in Europe – 5G network, offering customers a superior experience. As a country, the UK will benefit from the creation of a sustainable, strongly competitive third scaled operator – with a clear £11bn network investment plan – driving growth, employment and innovation. For Vodafone, this transaction is a game changer in our home market. This is a vote of confidence in the UK and its ambitions to be a centre for future technology."

The companies also claim that both Vodafone UK and Three are unable to get a decent return on their investments because they are “sub-scale… [which] limits their ability to continue to invest. After completion, MergeCo will have the necessary scale and a great platform to invest, grow and compete,” according to the parent companies.

But closing the deal will be tough. Even if it gets all the required approvals from the likes of the UK’s Competition and Markets Authority (CMA) and under the requirements of the UK National Security and Investment Act, the merger would not be completed until the end of 2024, the parent companies noted.

Industry analyst Kester Mann, director of consumer and connectivity at CCS Insight, believes the “deal should be approved. It is better to have three strong providers than two that are dominant and two that are sub-scale. Blocking it could thwart the long-term development of the UK’s telecoms infrastructure,” he noted in comments shared by email.

“This long-awaited mega merger represents the biggest shake-up in the UK mobile market for over a decade. The deal makes plenty of sense as both providers are sub-scale. As separate entities, it would have been near impossible for either to grow enough organically to come close to challenging BT or Virgin Media O2 for size. Inevitably, however, there will be widespread fears over job cuts,” added Mann.

And while he would like to see the deal approved, he’s not convinced that will happen. “An £11bn network investment plan will seek to allay regulatory concerns. But this deal will still face a major challenge to win approval. At this stage, I believe it is too difficult to call either way,” as the prospect that reducing the number of competing networks from four to three could lead to higher prices for customers “will be a major concern for the CMA. Vodafone and Three may have shot themselves in the foot by recently hiking tariffs by up to 14.4%,” he noted.

PP Foresight analyst Paolo Pescatore also sees sense in the “marriage of convenience… Scale is key to help lower costs and improve margins,” he noted in comments sent to TelecomTV.

But, he added, “it will take years before we see the real fruits of this deal come to fruition. The question is, can the UK wait that long? However, convergence still remains the achilles heel if this does get over the line. It would create a mobile champion that could increase competition in the wholesale segment of the market and become a partner of choice for MVNOs.”

And Pescatore also views CMA approval as the major stumbling block. “Convincing the CMA will be the real test… concessions on spectrum will have to be made and the entity will have to provide solutions on areas like network sharing, rather than create another problem.”

National security hurdles pose less of a concern, he believes. “There should not be any security concerns as the joint venture should be majority owned by Vodafone. I expect the Hutchison share to reduce over time. Hutchison already has an extensive presence in the UK, but this should be seen as a gradual exit from the telco market. Having the current Vodafone UK CEO heading up the new operation is a testament to this belief. His considered approach will resonate with key stakeholders and improve any chance of getting the deal over the line,” added Pescatore.

The publication of the merger details gave Vodafone’s share price a much needed lift after a perilous decline in recent months: By early Wednesday afternoon, the Vodafone Group share price had risen by almost 3% to 74.4 pence on the London Stock Exchange.

- Ray Le Maistre, Editorial Director, TelecomTV