via Flickr © Peter Krantz (CC BY 2.0)

- Too late for trade and technology embargos Mr Trump

- China has the size and the technology to be the world’s 5G behemoth

- No matter what year it gets to first stage commercial deployment

ABI Research reports that China has announced ‘aggressive plans’ for 5G and has positioned leadership in the global next gen radio scheme as a key element in its famous ‘Made in China 2025’. That strategic plan was kicked off by China back in 2015 and is essentially is a wide ranging effort to increase the Chinese domestic content of core materials to 40% by 2020 and 70% by 2025.

Think of China as a vast, formerly state-owned telco, probably located somewhere in Asia with tens of millions of subscribers and millions of employees. China is planning to subject its entire economy to an end-to-end transformation that, like a telco transformation, will involve employee outplacement and industrial re-tooling using AI and robotics to slash payrolls and improve quality, thus enabling it to compete in the future in its own and overseas markets. China is essentially looking to new technology to move it up the value chain.

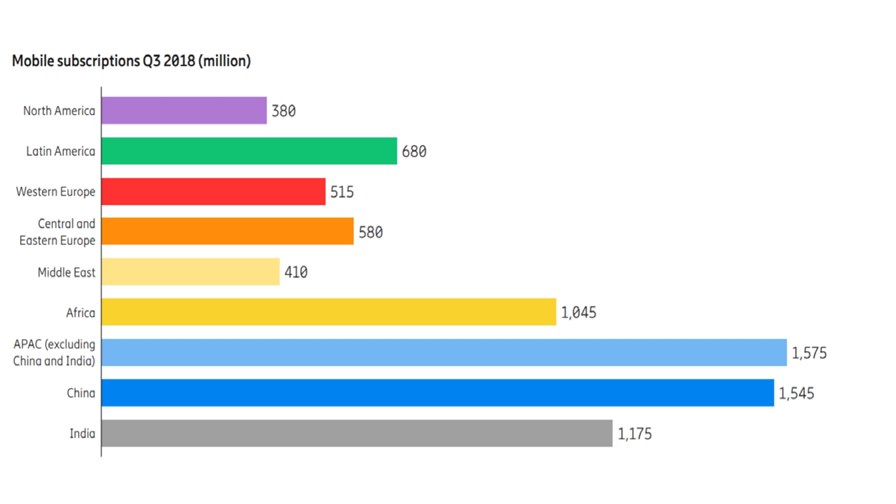

As we can see from yesterday’s Ericsson Mobility Report (see - Counting connections: Ericsson’s running commentary on mobile numbers) in 5G at least, the plan is already working a treat.

According to ABI despite China’s vigorous pursuit to win the 5G race, it is U.S. operators who will actually deploy 5G before their Chinese counterparts, but “while they won’t be the first country to deploy 5G, once they do, China will be the world’s largest 5G ecosystem with its 160 + cities with a population of more than 1 million and 15 cities with a population of more than 10 million. This will make China the biggest single mobile broadband market.” Indeed it will, by a huge margin.

Source: Ericsson

Off the back of that huge agglomeration of Chinese users, telcos and equipment vendors, China can use its telecom scale to become the prime supplier of infrastructure and (now) smartphones, to the adjacent mobile blocks - India and the rest of the Asia Pacific, which represent most of the global market.

As we pointed out yesterday, it’s one thing for the US to win a photo-finish in the 5G race to be first to deploy a commercial 5G network, quite another to turn that slim lead into some sort of sustaining advantage. That the US carriers will even get there first to claim bragging rights is highly uncertain. Today, for instance, Ericsson and Qualcomm claimed to have successfully completed the first 5G connection in Italy on TIM’s live network using the country’s first 5G prototype smartphone. It and many other telcos in Europe appear to be pretty close to claiming 5G commercial deployment too.

Read ABI Research’s conclusions below

China won’t be first to deploy 5G, but will ultimately be the world’s largest 5G ecosystem

London, United Kingdom - 27 Nov 2018

China has announced aggressive plans with the superfast "fifth generation" (5G) connectivity and has positioned the new cellular generation as a key pillar of its economic development initiatives. However, despite China’s vigorous pursuit to win the 5G race, it is U.S. operators who will actually deploy 5G before their Chinese counterparts, according to ABI Research, a market-foresight advisory firm providing strategic guidance on the most compelling transformative technologies.

“While they won’t be the first country to deploy 5G, once they do, China will be the world’s largest 5G ecosystem. At present, China has more than 160 cities with a population of more than 1 million and 15 cities with a population of more than 10 million,” said Emanuel Kolta, Research Analyst at ABI Research. “This will make China the biggest single mobile broadband market and the Chinese government aims to position 5G as a key technology in its industrial revolution strategy.”

ABI Research expects that China Mobile, China Unicom, and China Telecom will all start large-scale deployments in 2020, prior to 2019’s pre-commercial deployments. While the provision of enhanced mobile broadband to consumers will be the core proposition in early Chinese 5G deployments, industrial applications and network slicing will be the target of all Chinese operators. The Chinese central government has positioned 5G as a core component of its 13th Five-Year Plan and Made in China 2025 strategic plan to upgrade the Chinese industry. Augmented Reality (AR) and Virtual Reality (VR) have significant importance in consumer and industrial applications. While consumer application VR games are more well-known within the public, the Chinese government has high expectations for industrial applications of AR/VR, such as for virtual instruction manuals and virtual assistance.

The United States, China, South Korea, and Japan have been the forerunners in the 5G race. “For the winner, 5G will stimulate economic growth, establish geopolitical superiority, and even gain advantages in terms of military and intelligence powers. China has a unique position because its government does not just regulate the telecommunications market, but also actively shapes and encourages the market and its participants,” Kolta concluded.

These findings are from ABI Research’s 5G in China report. This report is part of the company’s 5G & Mobile Network Infrastructure research service, which includes research, data, and Executive Foresights.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.