via Flickr © Mark Justine Corea (CC BY 2.0)

- Tim Hoettges keen to change Europe's regulations and antitrust laws

- There are a few markets where in-market M&As could be possible

- But the EU, high levels of debt, and coronavirus are sizeable obstacles

Having finally completed the controversial merger of T-Mobile US and Sprint, Tim Hoettges, CEO of T-Mo parent Deutsche Telekom, is in no mood to ease off. Instead, he's keen to take Europe down the same road.

That might prove difficult for a number of reasons though, such as the EU's keenness to safeguard competition and Deutsche Telekom's big pile of debt. It's also worth noting that the mobile industry's response to coronavirus has highlighted just how much wiggle room operators actually have.

Nonetheless, Hoettges said in a Bloomberg report this week that the European telecoms market is too fragmented. "Wherever I see a deal or an opportunity for European market consolidation that's convincing, then I would always look at that with the partners."

He made those comments following the closure of T-Mobile's $26.5 billion merger with Sprint, reducing the number of nationwide US operators to three from four. Pledging to plough $40 billion into its network, and a three-year price freeze helped T-Mobile and Sprint win over the regulators, despite stiff opposition from consumer advocates who remain convinced that the deal will still ultimately lead to higher prices and less choice.

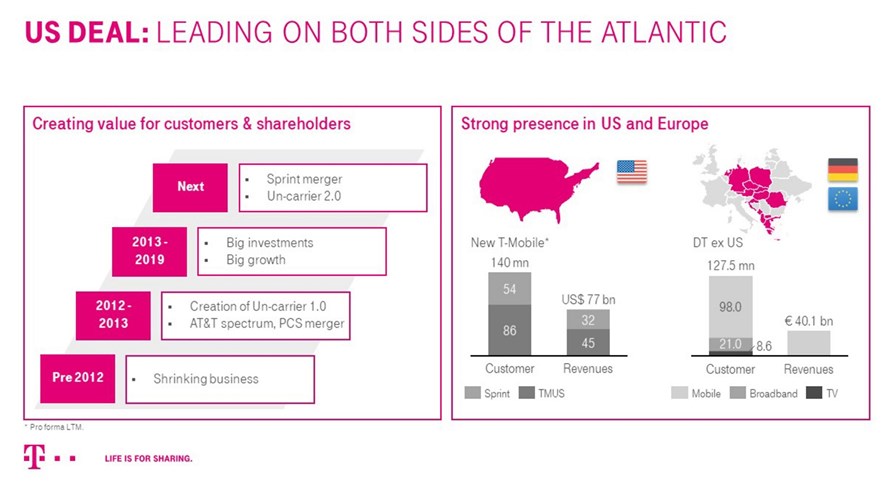

Hoettges' motive for pursuing a similar strategy in Europe is obvious given the T-Mobile/Sprint deal is expected to generate $43 billion in synergies. Furthermore, as Deutsche Telekom's chart shows, the newly-combined T-Mobile has 12.5 million more subscribers than Deutsche Telekom's operating footprint outside the US, but it generates nearly double the revenue. T-Mobile US was already DT's growth engine, after Sprint, it looks set to go into overdrive.

************************************

We want to hear from you!

Take part in our 5G and Security survey and receive a free copy of the downloadable report ahead of general release.

via Deutsche Telekom, April 2020

Limited options

A potential roadblock for Hoettges is the European Commission, which can be intransigent to say the least when in-market telco consolidation threatens to leave consumers with higher prices and less choice. As the incumbent in Germany, Deutsche Telekom would probably struggle to win approval were it to make a move for an altnet like Glasfaser, for instance.

In recent years, the EU's antitrust department has permitted some markets to consolidate from four to three players, including Austria, Germany, Belgium and the Netherlands, but approval tends to come with strict conditions designed to safeguard competition.

A quick look at Deutsche Telekom's EU operating footprint shows that of the 10 markets in which it offers retail services, six of them have three nationwide players, and the remaining four have four. It would be highly unusual for the Commission to sanction in-market consolidation from three to two players, so that leaves Hungary, Poland, Romania and Slovakia.

There is perhaps scope for doing a deal in these remaining four markets and generating some attractive synergies, and some players – and competition watchdogs – might be willing to play ball.

The timing could work to Deutsche Telekom's favour as well, because without exception, all of these markets are in the process of, or have just held, 5G auctions. The outcome of these auctions could leave some of the more cash-strapped or debt-laden operators looking for the exit, giving DT an opportunity to do a deal.

It's also worth remembering Deutsche Telekom still holds a stake in BT, a stake that has fallen sharply in value after the UK incumbent's share price collapsed in the wake of the Italian accounting scandal. Hoettges also sits on BT's board as a non-independent, non-executive director. Could he be cooking up a deal to which a Johnson-led, post-Brexit UK government might be amenable?

Maybe, but there are other factors to consider.

One of those is Deutsche Telekom's net debt, which stood at €76 billion at the end of 2019, up from €55.4 billion a year earlier. More than €15 billion of that increase was due to new accounting standards, while most of the rest came from dividends and spectrum acquisition costs, offset by free cash flow. That is a hefty pile of debt, even for an operator the size of Deutsche Telekom, and investors might balk at the idea of taking on more.

Then there is coronavirus, which is infecting every facet of life. It has revealed that telcos have more wiggle room than customers have traditionally been led to believe, as one after another they have increased data allowances to support those affected by lockdowns. Two potential consequences: it could be used as evidence that consolidation is not necessary to give customers larger data packages at competitive prices; and the hit on free cash flow from operations – caused because subscribers don't need to upgrade to a more expensive tariff in order to get more data – means there will be less money to spend on M&As.

In the Bloomberg report, Hoettges said he "will work with verve" to change Europe's regulatory and antitrust law framework. However, that still might not be enough to enable consolidation.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.