Source: Rethink Research

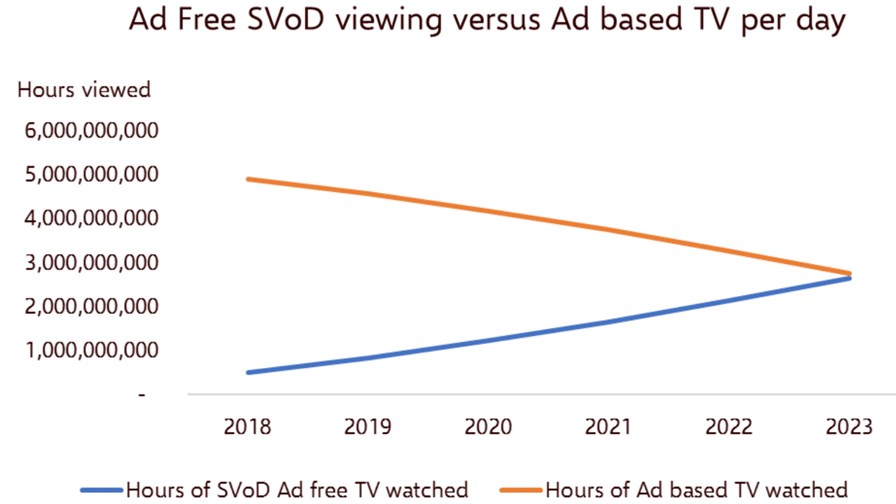

- Will match trad TV in hours watched by 2023

- Europe and the US adopting SVoD with gusto, but Asian markets prefer an ad-funded version

- Europe will be a mishmash of different approaches with US studios beginning to stake a claim, and local broadcasters ganging up to challenge them

Analyst firm Rethink TV has produced a report on the dynamics in the global TV market and maintains that ‘traditional’ linear TV is being remorselessly challenged by the Subscription Video on Demand (SVoD) business model. It claims that “SVoD uptake is accelerating and in terms of viewing hours per day, will draw a level with broadcast TV globally by 2023,” swamping it soon after.

Its new report “The rise in SVoD viewing to swamp traditional TV by 2023,” makes regional forecasts of SVoD usage and highlights the differences between Asia and the US and Europe.

Essentially Europe and the US is seeing subscription funded (mostly) video on demand traffic increasingly travelling over the internet - services such as Netflix along with more focused OTT video offerings. Meanwhile in Asia there is a similar pattern of adoption but, for financial reasons it tends to be ad funded (AVoD).

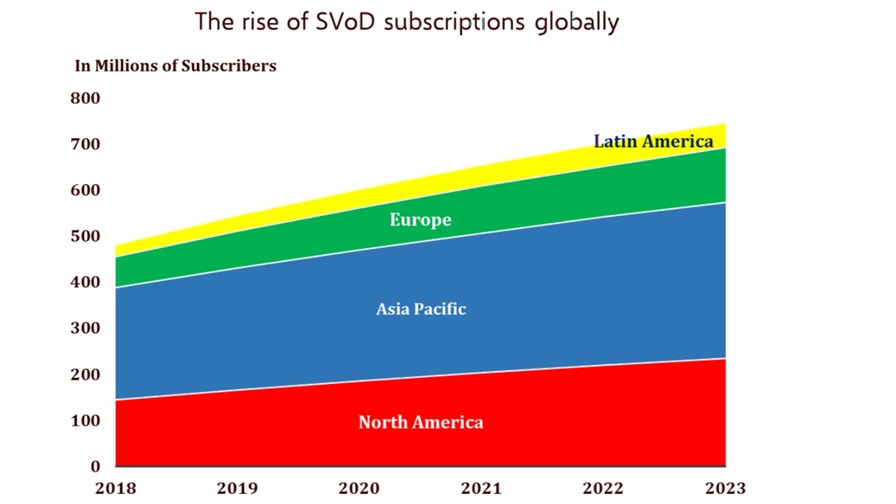

Rethink TV says it “sees 478 million SVoD subscribers today growing to 743 million by 2023, with China having the most SVoD subscribers by 2023, but North America still driving the largest dollar volume.

“We anticipate the US market rising from a combined paid SVoD (including vMVPD) reaching 236.6 million subscriptions by the end of 2023, from a base today of some 146.5 million.

“Europe and Asia will be neck and neck in SVoD revenues by 2023, but with far fewer subscribers in Europe, each paying significantly more than those in Asia, a region dominated by frighteningly large Advertising VoD streaming numbers,” it says.

Source: Rethink Research

According to Rethink TV, “One of the new leaders to emerge from the battle for the US market will be WarnerMedia, under its new AT&T defined, freemium strategy, reaching 29.6 million SVoD homes by 2023. Disney is also likely to have multiple SVoD service types, but may struggle outside the US.

Meanwhile “Europe will be a mishmash of different approaches with pure play US operators like Netflix and Amazon now established, US studios beginning to stake a claim, and local broadcasters ganging up to challenge them. The region has its own pure play SVoD players also such as Maxdome, Sky, Zattoo, and Rakuten TV.

“The Asia Pacific market is highly skewed with China expected to amass 245 million SVoD subscribers, some 72% of the total region, but the average spend will be just $2 to $3 a month. Latin American is a three horse race between the leader Netflix, America Movil’s Claro TV and Televisa’s Blim, with US studios looking to play King maker there.”

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.