via Flickr © 401(K) 2012 (CC BY-SA 2.0)

- European telecoms M&A deal value at US$69.6 billion last year

- Regulatory climate looks more favourable to consolidation

- Financial and political uncertainty remain an issue

- Investment firms still keen on telecoms assets

The total value of mergers and acquisitions announced in the telecoms sector in Europe in 2018 was the largest in four years and indications are that the broader TMT sector in EMEA has strong investment potential going forward, but if you're looking for a return to widespread consolidation in the telco space you could be disappointed.

The value of European telecoms M&A deals totalled US$69.6 billion last year, the highest level since 2014, albeit still some way behind the US$94.8 billion figure reported four years ago, according to new data from research firm Mergermarket. The numbers were buoyed in no small part by Vodafone's US$21.8 billion acquisition of Liberty Global's Central and Eastern European assets and the $10.5 billion investment group takeover of Denmark's TDC.

However, despite the uptick, it is notable that significant M&A moves are still lacking in Europe compared with a few years ago, when industry watchers and telecoms executives were philosophising on a future in which the number of competing network operators in Europe would be reduced to just a handful, creating a defragmented market akin to the telecoms promised land of the US.

It's tempting to blame the EU...although please don't make any judgements about my political leanings based on that statement.

It was in 2015 that the then recently-appointed European competition commissioner Margrethe Vestager shocked the industry by blocking the proposed merger between TeliaSonera and Telenor in Denmark on competition grounds that many argued were unfounded. That decision set a precedent; the EU put the kibosh on a planned merger between O2 and 3 in the UK the following year and there have been only a handful of significant M&A announcements since.

On a related note, the UK's planned exit from the EU is also having an impact on M&A in all sectors. "Prolonged uncertainty regarding the future relationship between the UK and the rest of the EU has caused a noticeable slowdown in M&A activity," Mergermarket analysts noted earlier this month. "The looming threat of a no deal [Brexit] scenario could see continued subdued activity in 2019," they warned, prior to Tuesday's defeat in parliament for the UK government, which is currently commanding endless column inches as eager hacks feel the hand of history on their shoulders. As it stands, uncertainty still abounds and uncertainty remains the enemy of investment.

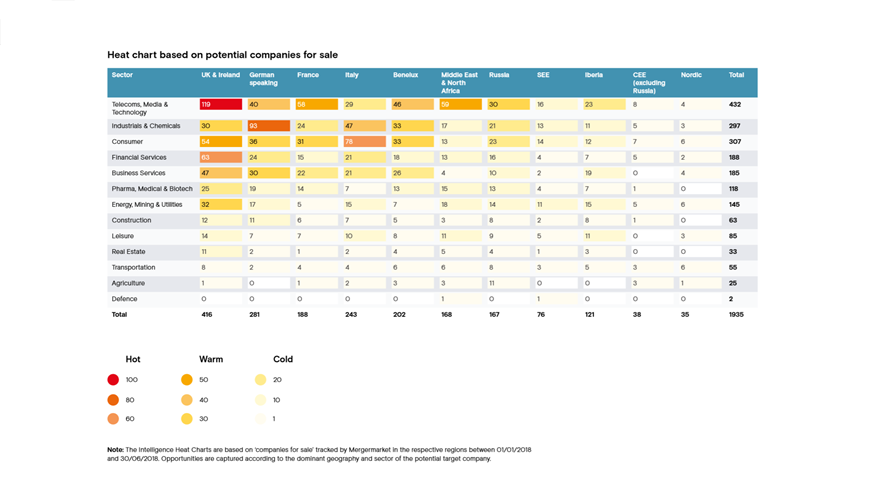

That said, Mergermarket's latest M&A Heat Map, which tracks potential M&A activity across the EMEA region, shows that the hottest spot for deals in the coming months is likely to be the TMT sector in the UK and Ireland. That chart was published in August, amidst frenzied Brexit speculation, so its predictions are likely still valid.

© Mergermarket

Furthermore, there are indications from Brussels that in-market consolidation is no longer taboo.

Late last year the European Commission gave an unconditional approval to Deutsche Telekom's takeover of Tele2 in the Netherlands, despite potential competition concerns. Suggestions of political machinations aside, that green light potentially opens the way to increased M&A activity in the 27-member bloc.

But while deals will undoubtedly come, significant changes to the European telco landscape in the near future are unlikely.

Mergermarket noted the following in its assessment of 2018: "Rising protectionism, government intervention, and continued uncertainty have all undoubtedly caused firms to reconsider high-profile investments." These are not hurdles that will be easily overcome. Mobile operators have bought up fixed assets in a number of markets in recent years, Vodafone's ongoing Liberty Global deal being the latest example, but there are still too many barriers to the big national incumbents participating in big M&A deals.

However, telecoms is still an attractive proposition to investors, as demonstrated by TDC's takeover by a group comprising Maquarie and three pension funds, and Telenor's successful sale of its CEE operations to private investment group PPF, both of which took place this year.

Market-altering consolidation may not be on the cards, but there are parties willing to get the chequebook out for the right asset.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.