Source: Synergy Research Group

- The major cloud services firms have reported their first-quarter results

- Synergy Research Group has gathered the data and reports major growth in what is already a massive market

- Global spending on cloud services surged as demand for generative AI (GenAI) workloads continues to fuel the sector, which now has an annualised value of more than $300bn

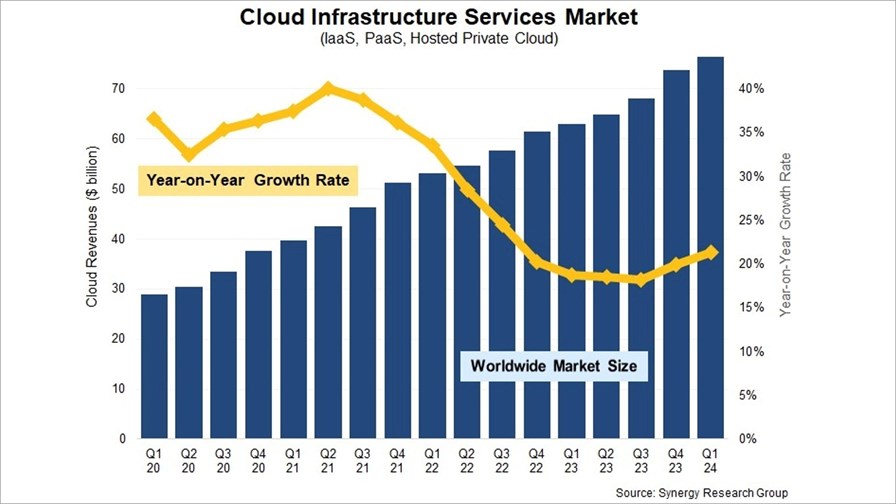

The appetite for cloud infrastructure services remains unsated, it seems, with Synergy Research Group reporting that the global sector was worth a staggering $76.5bn during the first quarter of this year, up by 21% (or $13.5bn) compared with the same period a year earlier. Based on that figure, the market is now worth more than $300bn per year.

With the first-quarter numbers from Amazon Web Services (AWS) now published, the Synergy Research team has been able to assess the trends in the worldwide market for cloud infrastructure services, which comprises infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) and hosted private cloud services. Enterprise spending on these services was “well over $76bn worldwide”, despite ongoing “economic, currency and political headwinds”. However, “the underlying strength of the market is more than compensating for those constraints, aided in no small part by the impact of generative AI technology and services,” according to the research firm and, as a result, the sector’s growth rate is once again increasing (as the chart above shows).

The sector continues to “grow strongly in all regions of the world. When measured in local currencies the APAC [Asia Pacific] region had the strongest growth, with India, Japan, Australia and South Korea all growing by 25% or more year over year,” according to the firm, though the US market, which grew by 20%, remains “by far the largest cloud market, with its scale surpassing the whole APAC region,” noted the research firm.

“Synergy reported that in late 2022 and through much of 2023, cloud market growth rates were abnormally low, held back by external factors. We forecast that growth rates would bounce back and that is what we are now seeing,” noted chief analyst John Dinsdale. “In terms of annualised run rate, we now have a $300bn market, which is growing at 21% per year. We will not return to the growth rates seen prior to 2022, as the market has become too massive to grow that rapidly, but we will see the market continue to expand substantially. We are forecasting that it will double in size over the next four years.”

Market forecasts are usually to be taken with a pinch of salt, as us Brits would say, but Dinsdale and his team know this market well and have an excellent track record. It should also be noted that such staggering growth will be helped by the increasing number and capacity of hyperscale datacentres that are being constructed around the world – see Hyperscale datacentre capacity doubling every four years – report.

As ever, AWS remains the cloud infrastructure services sector leader, with a 31% market share, though Microsoft (25%) and Google (11%) are growing at a faster pace. That trio dominates the sector, accounting for two-thirds of the total global market: The next biggest player is Alibaba, with a 4% market share, followed by Salesforce (3%) and a quartet of companies with a 2% market share – IBM, Oracle, Tencent and Huawei.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.